Skip to main content

10 new features and changes in QuickBooks for GST

10 new features and changes in QuickBooks for GST

The Government of India is rolling out new indirect tax law – Goods and Services Tax (GST) on July 1, 2017, which in turn impacts how businesses manage their transactions, do their accounting and file their tax returns. QuickBooks has added new capabilities and modified its existing capabilities to ensure that its users are GST compliant and can continue to use QuickBooks without any disruption.

This article summarizes the changes to QuickBooks for GST:

What system did under the hood:

Automatic creation of GST tax agency and all the GST tax rates – For users who have already set up taxes in the past, QuickBooks will automatically create a new GST tax agency and the GST tax rates. For users who haven’t set up taxes in the past, they need to manually set up GST tax agency. Once done, the GST tax rates will automatically show up in their transactions.

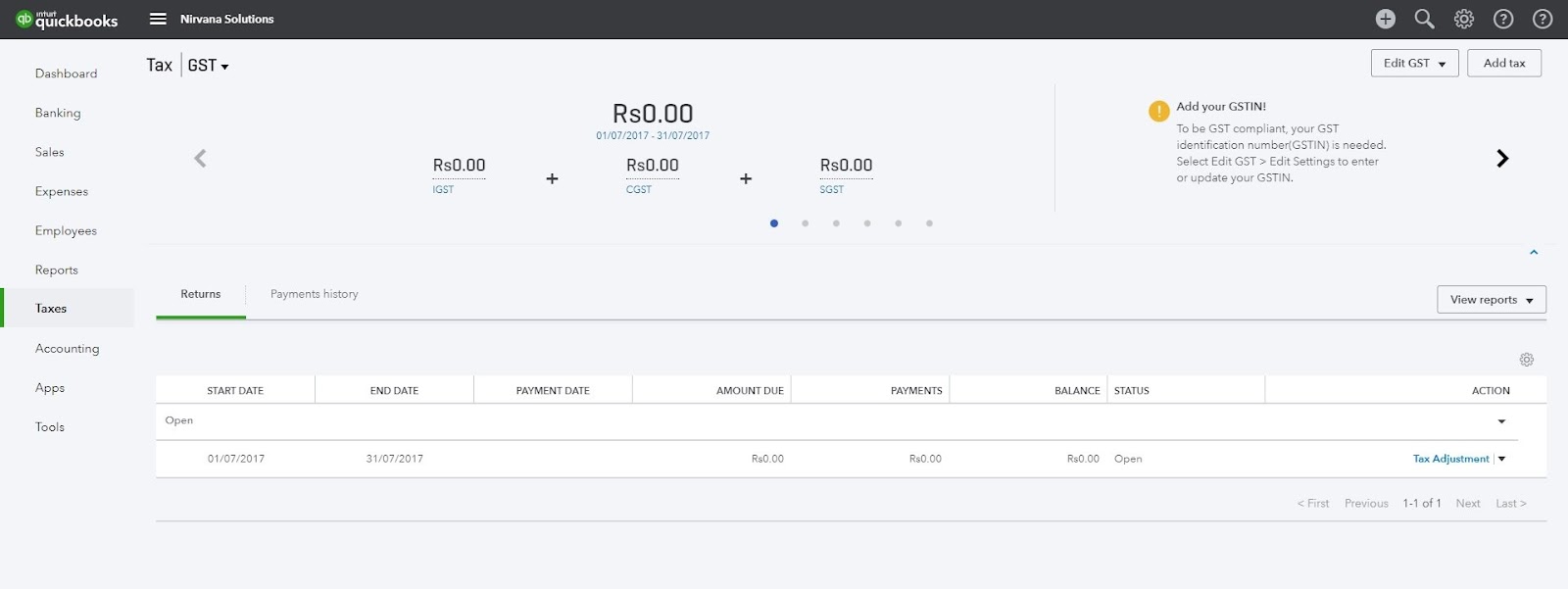

New GST tax center to tell the user how much tax it owes – GST tax center displays the balance due per filing period classified by different tax types and allows the user to complete important functions like adjusting tax and recording tax payment.

New Chart of Accounts (CoA) to handle accounting treatment of GST tax flows – QuickBooks now contains CoAs for the GST agency and the underlying tax types (i.e. CGST, SGST and IGST) to allows users to properly manage how taxes are treated.

What user needs to do to complete GST setup in order to generate compliant invoices and returns:

Add company GSTIN – Users can now add their company GSTIN to their company set up for creating GST-compliant invoices.

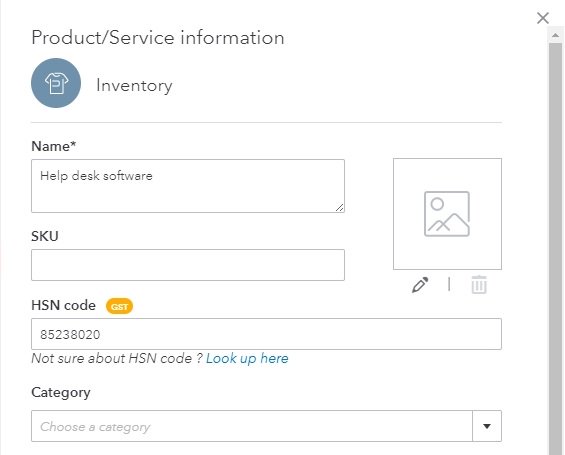

Add a new item code (HSN/SAC) for products and services – Users can now add a unique HSN code to their products (inventory and non-inventory items) and select SAC code for their services. Once added, the codes get displayed in the invoice which gets printed and also gets displayed in the return reports.

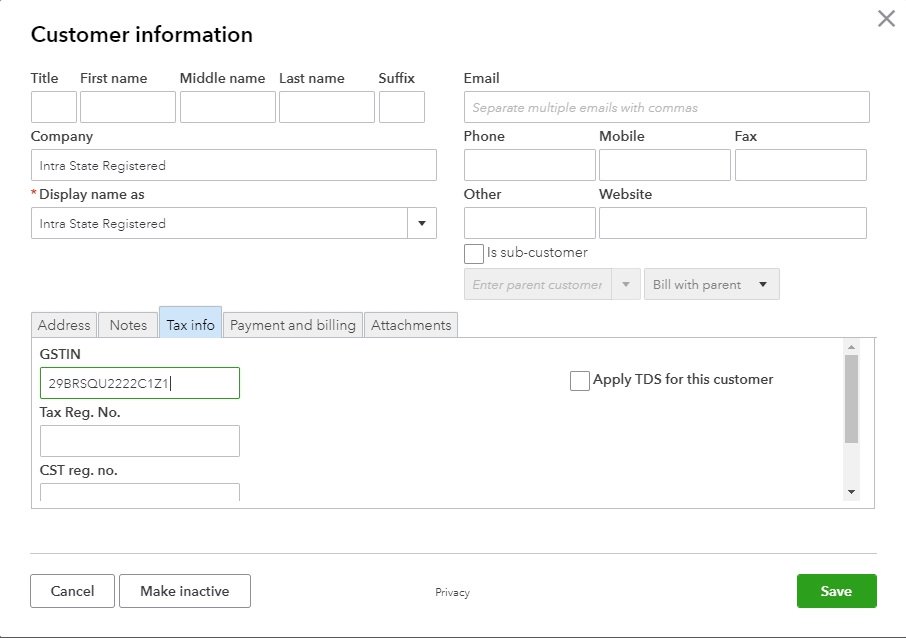

Manage GSTIN for applicable customers and suppliers – Users can now add GSTIN of their registered customers to display them on GST compliant invoices and GST return of sales/outward supplies – GSTR1. Also, GSTIN of registered suppliers can be added to display them on GST return GSTR2.

Custom sales form gets new fields for Item Code (HSN/SAC) and Customer GSTIN – Once selected by the user, these fields appear on the invoices to make them GST compliant.

Invoicing:

New tax rates will display in transactions (i.e. invoices, expenses) – When transaction date is set to on or after July 1, 2017, users will notice the GST tax rates of 0%, 5%, 12%, 18%, 28% and ‘Exempt’. Each tax rate will have two entries – one for transactions within the state (intra-state transactions), i.e. 18% GST and other for outside the state (inter-state transactions), i.e. 18% IGST. In the former case, the system will automatically break up the tax computation into CGST and SGST tax types, i.e. 18% GST will split into 9% CGST and 9% SGST. Also note that based on the transaction date, the system will display either the GST rates (i.e. on or after July 1) or old rates like Service Tax, VAT (i.e. prior to July 1).

Indicate “Place of Supply (POS)” in sales transactions (i.e. invoices, estimates and sales receipts) – The screen of invoice creation now includes a new field called as “Place of Supply”. By default, this field displays the State of Shipping Address of the selected customer. POS will help the user determine the right tax type, i.e. GST if the transaction is within the state and IGST if the transaction is outside the state. For transactions outside India (export), the user needs to select “Outside India” option within the POS. Accurate POS selection is important as it gets reflected in the return reports.

Below is snapshot of a GST compliant invoice generated in QuickBooks (changes highlighted in yellow)

QB invoice 07Jul17

Users are recommended to go through the help article Setting up QuickBooks for GST to understand how they can use the above capabilities to set up for generating GST compliant transactions (i.e. invoices) and ensure reports for GST returns are complete and accurate.

You can also view the short video which explains how users can set themselves up and generate GST compliant invoices.

Reports:

GST return ready reports – With this release, QuickBooks includes built-in reports for GSTR1 (for outward supplies/sales) and GSTR2 (for inward supplies). Users can review these reports and export them to initiate their return process. NOTE – The Government of India has indicated that detailed return filing may not be applicable for the first two months and businesses will be required to file summary returns. The current reports in QuickBooks shall be relevant only when detailed filing is initiated. Support for filing in the interim shall be communicated once such format is made available by the Government.

Hope this article will be beneficial for you. To get more information and best support, dial QuickBooks Payroll Support Phone number 1-855-441-4417.

Comments

Post a Comment